What are the benefits of AP automation?

Stratas specialise in Accounts Payable (AP) Automation, but what are the benefits of AP automation?

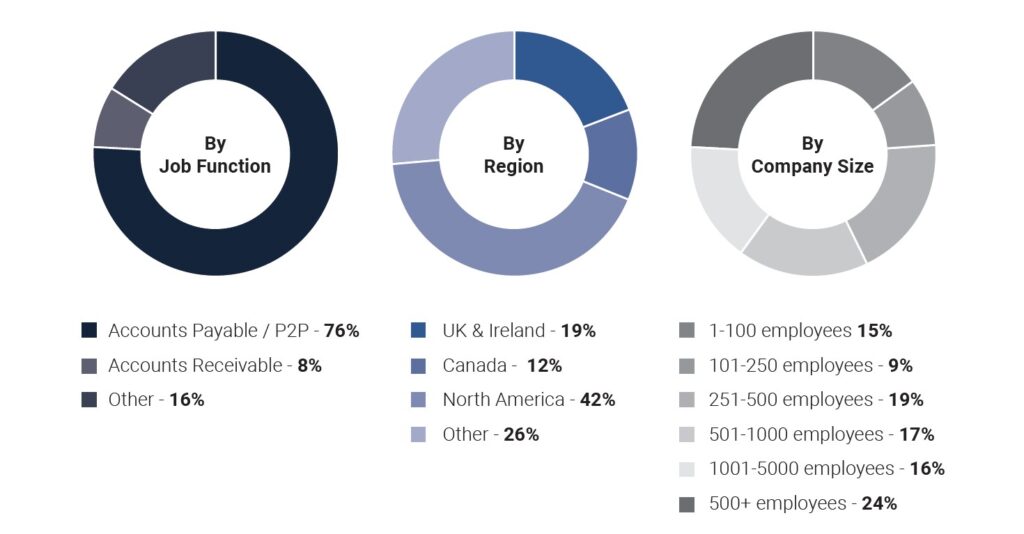

The IFOL has released a recent study that demonstrates the impact of manually processing invoices in accounts payable. They have a diverse profile of survey participants to provide a broad view of finance operations across the world, from companies of all sizes, and finance teams of all sizes.

Too many finance teams are working with outdated processes

The study found that: 40% of teams are working with outdated and inefficient processes. This means that two-fifths of global respondents do not think their finance team has modern and efficient processes.

Just over three-quarters of the respondents (76%) think their finance team needs to review the processes. There is an acute awareness within finance teams worldwide that processes need improving.

Accounts Payable processes are the most inefficient

The top three processes considered ‘inefficient’ or ‘highly inefficient’ are all Accounts Payable processes. These are:

- Purchase Orders

- Invoice Processing

- Invoice Approval

In addition, when asked specifically what their most manual processes are, respondents more frequently named AP processes as well. With the undeniable trend of AP processes being the least efficient, is this function generally overlooked by finance teams?

Process improvement is not always a regular practice

Only 43% of teams regularly review their processes. Their study revealed that less than half of finance teams regularly review their processes throughout the year. Only 17% review them once a year, 11% every 2-3 years, and 7% never review their processes. The top three problems created by poor processes are:

- Manual processing time delays

- Errors from manual processing

- Lengthy invoice approval

Sustainability could be improved

100% of respondents said sustainability is important to them. Encouragingly, 54% of companies have a sustainability programme in place, but 23% don’t have one, and a further 23% of respondents didn’t know. Just over half (54%) say their company has a clear sustainability strategy and goals, and 61% believe their company shows that sustainability is important to them through their actions. By automating AP you can use technology to replace paper processes and therefore create a more sustainable work environment.

Most accounts payable teams still remain in a partially automated state

Despite an incremental year-on-year increase in the percentage of teams expecting to be fully automated within the next 12 months, we are still seeing the majority of teams sitting in a partially automated state. 67% of teams manually key invoices into their ERP/accounting software, 58% spend more than 10 hours a week processing invoices and administering supplier payments and 75% of teams spend over 5 days each month. Why is manual processing a problem?

- It delays the delivery of goods/service

- Creates stress for the AP teams

- Leads to fines and penalties

AP teams are still committed to automation

66% teams expect to be fully automated within the next three years. Whilst the transition to full automation remains steady since 2019, the commitment is still there. The top two reasons for automating AP processes are to:

- Speed up the payable process

- Increase visibility across invoice process

75% respondents believe that automating AP would free up their finance team to focus on more strategic initiatives.

Accounts payable fraud is happening to a team near you

The study revealed that 44% of global finance teams know of someone who has been a victim of accounts payable fraud in the last three years. That’s more than two in every five teams.

The most common types of accounts payable fraud experienced are:

- Duplicate invoices for goods and services

- Expense fraud

Nearly half of teams (44%) say they could identify fraud within a few days with their current AP process, but just under one-fifth (19%) say it would take a few months and 6% would only identify fraud after year end.

More needs to be done to tackle finance fraud

A staggering 81% of respondents believe their AP manager could do more to protect the finance team from accounts payable fraud.

44% of respondents felt the most effective way to protect themselves against fraud is to automate the accounts payable process, with 31% believing fraud training for the team was the most effective. A further 25% felt that more regular maintenance of the vendor master file was important. The data shows a potential training gap with 88% of respondents stating that their team would benefit from accounts payable fraud training.

So what are the benefits of AP automation?

- Update your processes

- Make your processes more efficient

- Improve your processes

- Become more sustainable

- Become fully automated